The Siren Song and Its Aftermath

Monday, January 14, 2019

In 2018 investors succumbed to the song of the Sirens. In the ancient Greek myth, the Sirens were half-woman, half-bird creatures inhabiting the rocky island of Anthemusa. Their seductive singing to passing ships compelled captains to reset their course and crash against the jagged coast, and drove sailors to jump into roiling waters to their death. The wise hero Odysseus lashed himself to the mast when sailing nearby in order to avoid the temptation of their hypnotic songs about chests filled with gold coins and jewels hidden in the island’s caves.

Now, thousands of years later, in the first half of 2018, unwary investors were likewise seduced by the sweet melodies of today’s Sirens — Amazonia, Applonia, Facebookia, and the others. Even seasoned professionals could not maintain the discipline they had learned over years of navigating market waves, headwinds, and tailwinds.

The myth of the Sirens represents an early embodiment of behavioral finance. It’s a morality tale, offering existential annihilation as the endgame for abandoning the science of navigation in favor of greed and dopamine rewards.

Today’s Sirens Have Fangs

We’ve seen this scenario before, most recently in 1999–2000 at the tail end of the tech bubble. To be sure, this time around was less ruinous, perhaps because the last time the Sirens sang so loudly was still lodged in most investors’ memories. Also, the tech companies involved today actually are different. For one, we can measure their revenues and growth, rather than applying the nonmetric of euphoric overconfidence that was rampant during the tech bubble. Further, the “new economy” proposed in the late ‘90s has indeed become much more of a reality. And to many observers, today’s tech leaders were not all that expensive.

Still, there was something wrong with the market of the past few years, climaxing in midsummer. It was supposed to be the best of all possible worlds. The year 2017 had offered one of the lowest-volatility rallies in stock market history. You'd just buy stocks, and they would gradually rise, like dough. Then the corporate tax reduction bill passed, bumping up the profitability of already-profitable companies, allegedly enabling the repatriation of overseas funds for many. A rogue wave of profits and stored cash was about to hit. Would there be enough shares to fill the demand, investors worried? So every "dip" found buyers.

Yet the market was not quite what it seemed, an odd shape most investors didn’t take seriously, especially if they were in index funds. Index strategies got a big boost from the returns of a handful of new-era stocks, while the vast majority of stocks simply marked time.

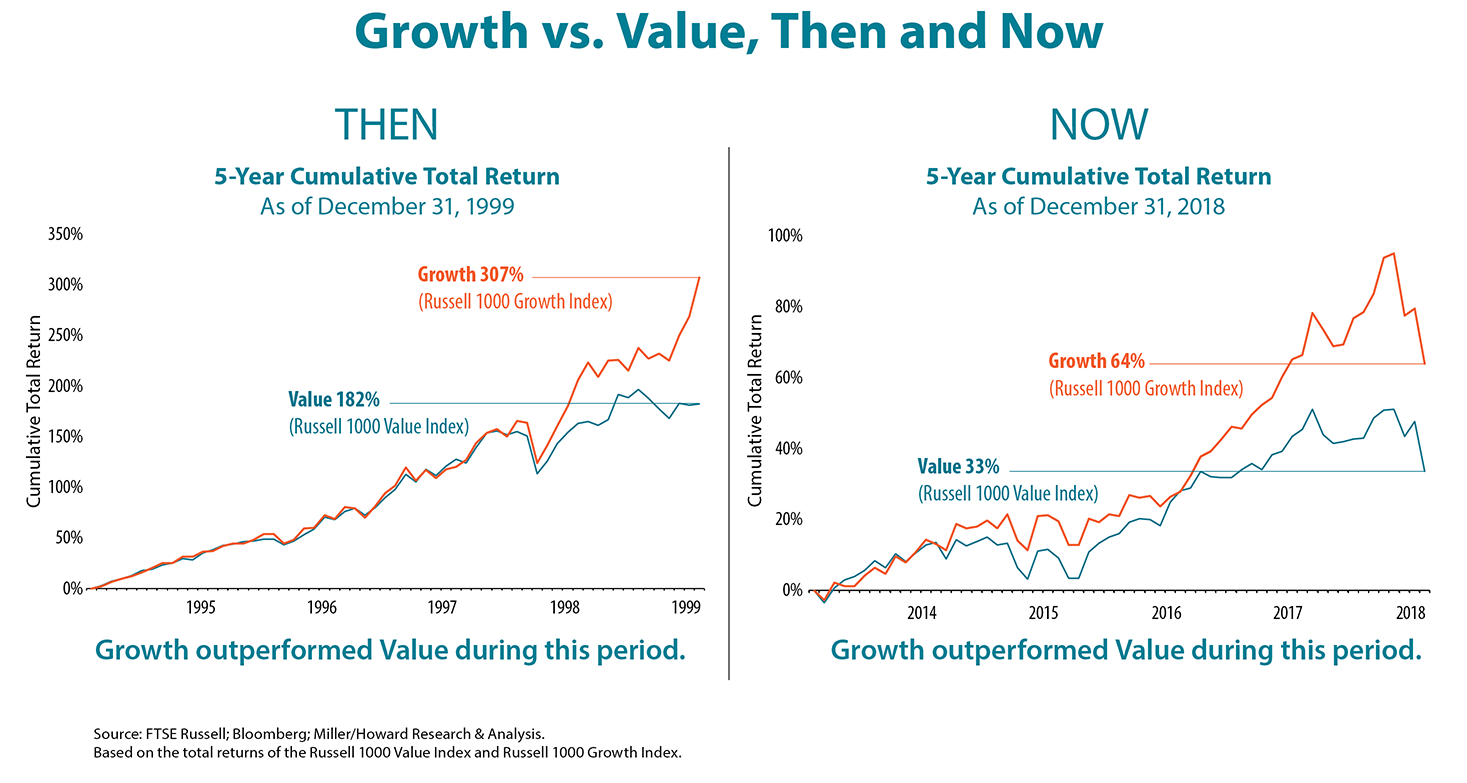

Consider the relationship between the FAANG stocks (Facebook, Apple, Amazon, Netflix, Google) and the S&P 500 Index during the first half of 2018. As it turns out, just the five FAANGs were so strong — and built up so much weight in the index due to that strength — that the little group accounted for nearly all the gains in the S&P 500 Index. Put another way, the large mass of other stocks had a net loss, though the index showed “gains.”

This is not the way it’s supposed to be, if you’re a true investor.

Growth Twisted away from Value

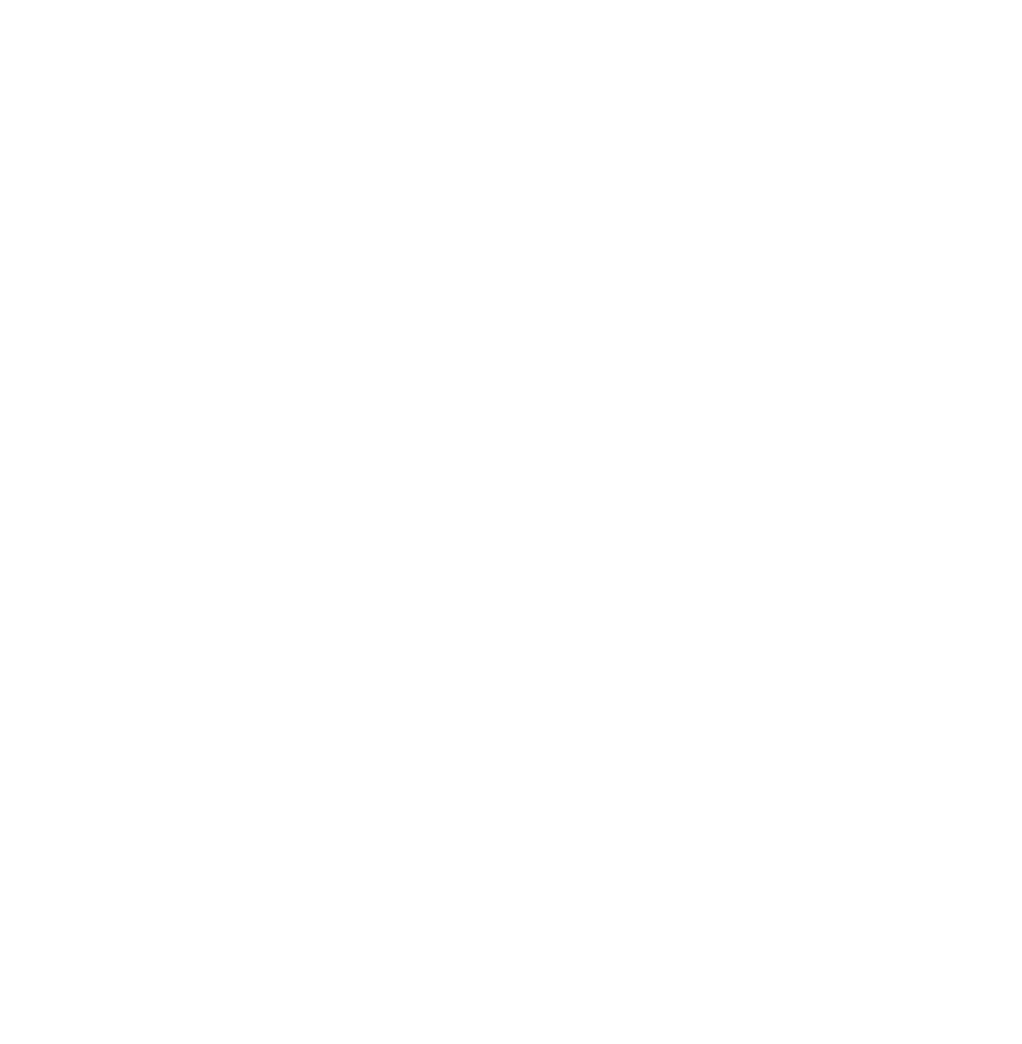

As noted, we’ve seen this movie before. After the tech bubble burst in 2000–01, a five-year period where “growth” stocks convincingly outperformed “value” stocks came to a sudden end. Interestingly, the disparity between growth stock and value stock performance then and the same dichotomy today — after the debacle of the fourth quarter of 2018 — is extremely similar.

Does this mean that the relationship is about to make a marked shift, “normalizing” the valuation of growth and value stocks? There are no rules. There are tendencies, there are generalities, and there is analogous history (the last of which seems to be the touchstone for those possessing “market wisdom,” and which indeed can often serve as a guide if not a certainty).

There are also differences in conditions. For example, in 2000–01 many of the lower-volatility or defensive stocks were historically cheap. Today utilities are near record high valuations, so one would not expect a repeat of the early 2000s. As many academics have shown, and as any person on the street knows intuitively, future returns are inversely proportionate to starting valuations. Another classic defensive group, consumer nondurables, has recovered from extreme cheap valuations, but the group is suffering from evolving consumer taste and habits, competition, excess supply, and changes in distribution. It offers, as a group, fairly dim fundamental prospects without excessive “cheapness” to counterbalance that.

It would be nice to think that the market has been de-FAANGed, but the alternatives are not as appealing as they have been in past periods. Furthermore, the “hot” companies of today are real businesses, with real growth, and further declines in price may set them up as value stocks with growth, an ideal combination. But memories are short, and investors burned in the second half of 2018 will be chary of the same companies that betrayed and deserted them — after everything was going so well!

Understanding the Sentiment Factor

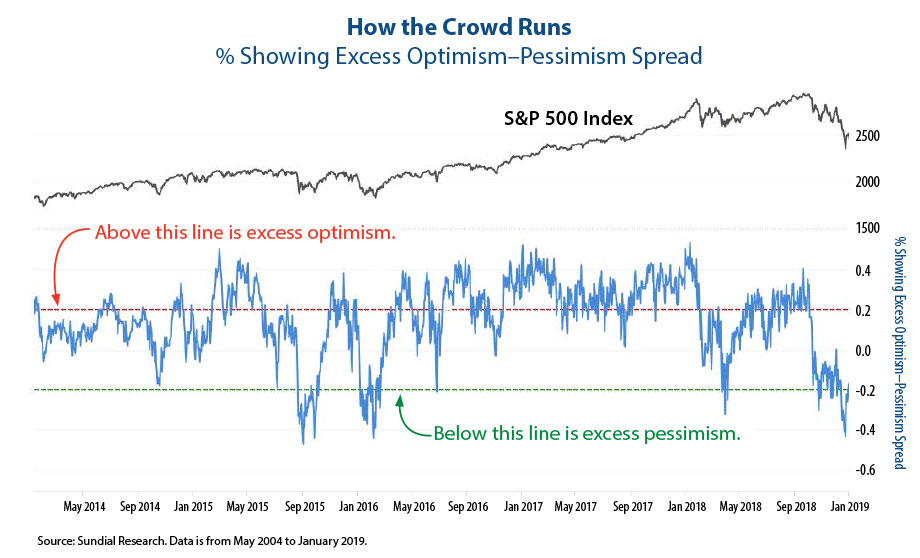

Investors will gravitate to whichever Sirens sing most beautifully, as always. Greed and fear influence the markets — no matter how detailed an investor’s spreadsheet and valuation formula. And the repetitions of quantitatively measured sentiment at extremes are far more helpful to investors than a guess about the specifics of the next change. Broadly speaking, these are not a mystery, as seen in the CNN Money: Fear and Greed historical chart.

When markets rally strongly, there comes a time when everyone believes, and that is the cue for Siren music to play, hypnotizing all those already in a position to stay there, and drawing in all those outside to come in. When markets crash, the music stops, investors flee, and the cycle starts all over again.

Seeking Quality to Neutralize the Siren Song

Is there a neutralizer for these perpetual cycles? Are there virtual noise-cancelling headphones an investor can put on both to avoid the panic and fear driving others and to remain calm enough to take advantage of errors of the masses?

We think quality is the antidote for investment emotions. Whether the portfolio in question is focused on dividends or more broadly on infrastructure, we always start with quality as a criterion. Why? We think the key to long-term success in equity investing is holding stocks that you can comfortably retain even when the Sirens have sung to the market and storms are churning the seas. To be sure, not every period will offer rewards for even the highest quality stocks, and there are many periods throughout history when investors have flocked to lower-quality stocks, inducing higher returns than the broad market or better companies can offer. But stocks are always an arena of decision making; even simply holding a stock is a decision (versus the decision to buy or to sell). What we want are holdings with a visible and durable long-term viability, stocks that will be here tomorrow and will survive and thrive until the next time investors decide they have become too cheap or undervalued compared to their ability to generate cash flow in the year ahead.

Quality means that economic stress will not pinch the company so much that it can’t easily handle its debt. Quality means the company has existed for many years and shown its ability to both maintain and expand its business in a variety of different economic and competitive climates. Quality means the company recognizes who owns the company — the shareholders — and shows it through dividends and share buybacks as well as modest executive compensation. Quality companies don’t take on unnecessary environmental risks and don’t risk disarray through poor treatment of employees. For quality companies, competition is generally limited in pressure, and deep reliance on commodities will always raise a question, even for the lowest-cost producers.

We believe that these are the stocks that will grow over time. These are the stocks whose underlying business is sufficiently stable to allow the investor some peace of mind to hold through difficult times that inevitably arise in the equity markets. These are the stocks that can help neutralize investing mistakes that spring out of sentiment factors such as fear, recency, extrapolation, herding, or the feeling that one must “do something.” We feel investors who, like Odysseus, are disciplined to resist the Sirens’ seductive song will find safe harbor if they seek quality stocks like the ones we hold.

Lowell G. Miller founded Miller/Howard Investments in 1984. Lowell has served as President and Secretary of Miller/Howard's Board of Directors, as well as President (Principal Executive Officer and Trustee) of Miller/Howard High Income Equity Fund, and Chairman of the Board of Trustees of Miller/Howard Funds Trust, since the funds’ inceptions in 2014 and 2015, respectively. He began his studies of the securities markets as an undergraduate and has continuously pursued the notion of disciplined investment strategies since 1976. He is the author of three acclaimed books on investing, including The Single Best Investment: Creating Wealth with Dividend Growth (Print Project, 2nd Edition, 2006). He has also written on financial topics for The New York Times Magazine, and has been a featured guest on Louis Rukeyser's Wall $treet Week and Bloomberg TV. Lowell is frequently quoted in financial media such as The Wall Street Journal, Dow Jones Newswires, Bloomberg, Fortune, and Barron's. He holds a BA in Philosophy from Sarah Lawrence College and a Juris Doctor degree from New York University School of Law.