Is the End Really Near?

Monday, July 01, 2019

Things are not so bad after all.

Investor negativity is in vogue at the moment. Instead, we see a positive side to the story that’s ignored now—perhaps because it doesn’t make for good headlines. But first let’s look at some factors that are contributing to the prevailing sentiment.

“Banner Year”: More Hype than Reality?

At the end of the second quarter there was much commentary on what a banner year it has been (up 18.5% on the S&P 500 Index), what a fine June (the best, the best), what great new record highs. The Financial Times headline proclaimed, “S&P has best first half since 1997.”

What’s forgotten, of course, is that stocks ended June just a whisper above the levels seen in September of 2018, nine months ago. The big market story of 2019 so far has been mainly a recovery from the lows at the end of last year, driven then by the Fed shaking rattles about increasing rates, rattles it put back on the shelf—inspiring one and all to come and buy back what had already declined sharply. Indeed, December of 2018, we so quickly forget, was the worst December in the past 30 years, and the seventh worst of any month in the past 30 years. The same thing happened in June—if May had not been so miserable and down, June likely would not have been up so much. (Note: The biggest gains generally come when assets are recovering off a low.) Indeed, June’s close, after a 7% run, was actually lower than the high of May. The return to investors since last September has been well below historical averages, and not much return for all the volatility undertaken. Actually, the Russell 1000 Value Index, by price, is still below where it was at the end of January, 2018. That’s 17 months without a morsel for the average value index investor

"We suspect that investors are still smarting from fresh memories of the end of last year; returns that would ordinarily inspire animal spirits and mass bullishness have done nothing of the sort."

Investors Wary Despite Gains

Investors are uninspired by the landscape. Never mind that the last six months have offered good broad market returns. We suspect that investors are still smarting from fresh memories of the end of last year; returns that would ordinarily inspire animal spirits and mass bullishness have done nothing of the sort.

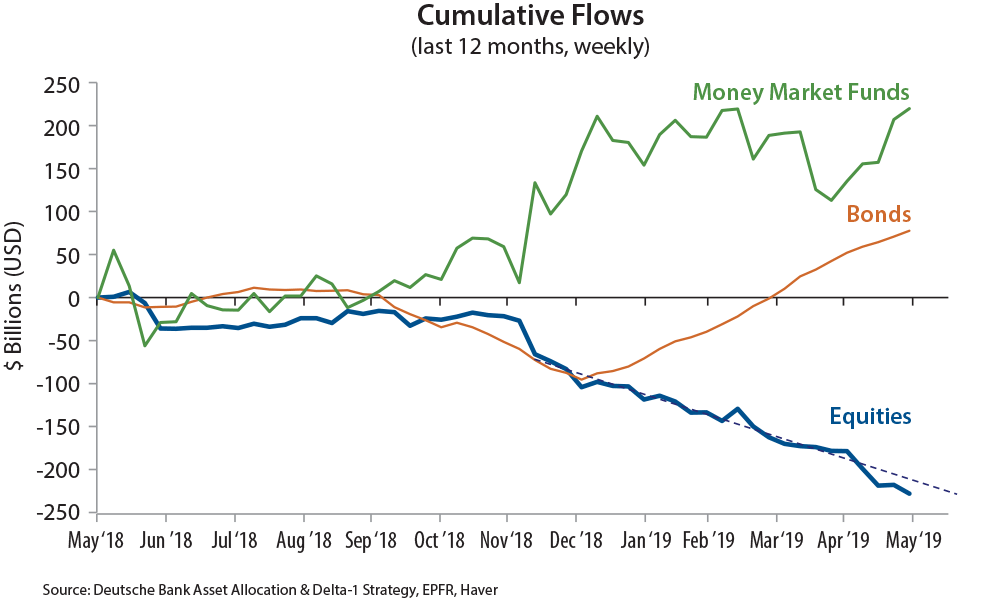

Flight to Cash over Equities. It’s often said that prices in the market and across the economy move in response to demand, but we are at a point where rising prices have apparently dampened demand.

“Flows,” in the chart above, reflect changes in fund holdings. Ordinarily we would look to high exit levels as representative of bearish herding and therefore bullish for the future—when a reversion to the mean gains traction—but something odd is going on. We can’t recall, nor have we found in the data, a time when investors fled equities with such duration and such magnitude at a time when stock prices have been rising strongly (though flows have been negative to a more modest degree for the past five years). Especially in 2019, prices have risen in the face of falling demand for the merchandise. That’s not really normal; it must be part of the new normal.

Margin Debt Breaks Historic Pattern

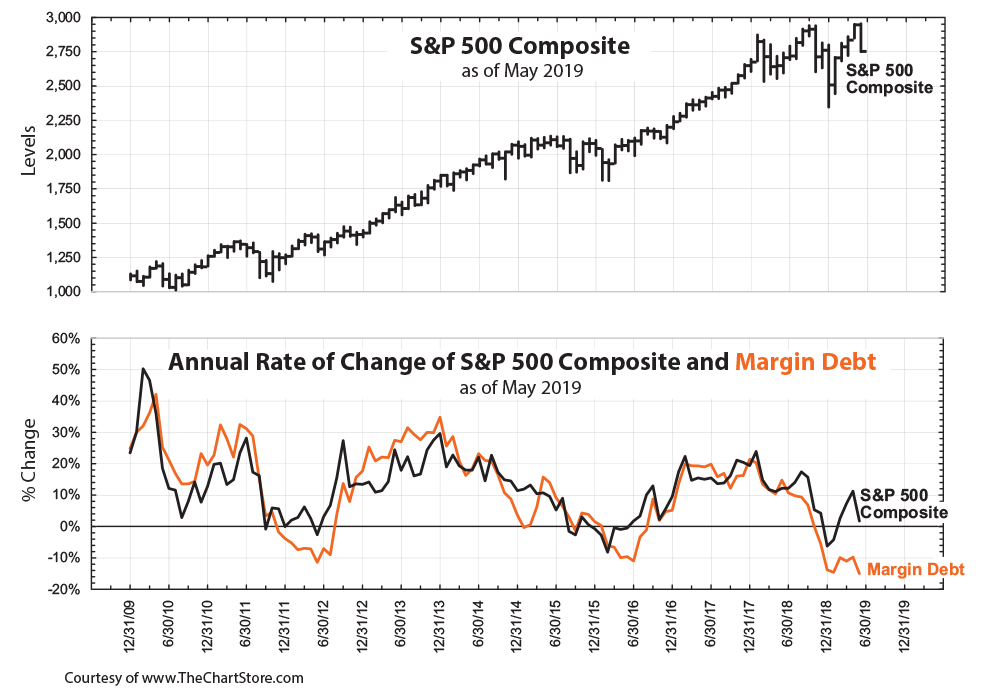

A similar sentiment is found in tabulations of margin debt. It has long been our rule of thumb, derived from countless observations, that market rallies are unsustainable unless margin debt rises commensurately, or roughly so. In the pair of charts on the next page, we see the high correlation of margin debt rate of change and S&P 500 rate of change. Rising prices inspire leverage to those rising prices, in a nutshell.

A New Rally Without Rising Margin Debt. Over the past 10 years (and it is true for any prior period you choose to observe), rising S&P prices are associated with rising margin debt, with stock prices usually leading. But in 2019 that solid pattern was broken; stocks rose, margin debt did not. The more aggressive segment of market participants did not interpret the rising market as a precursor to further rising prices, and kept their wallets in their pockets.

The behavior of this market segment can be viewed optimistically. This can be viewed optimistically, since at low points in the market a large spread between stock price rate of change and margin debt rate of change often develops, as we see currently. That sets the stage for a rebound. But as of the end of the second quarter the market was not at a low point, it was at a high point, and margin debt failed to respond. It is the number to watch to evaluate whether the market can rally sustainably in current conditions. Rising margin debt would be a great relief, at this point.

Expensive Bonds Not Deterring Demand

More oddities are unfolding in the current market. As we write, 10-year bonds yield 2%, or about 54% of the yield on our Income-Equity portfolio (to take just one example), whose income may be tax advantaged and has the potential to grow. It’s a rare moment in history to see bonds continue to be so expensive (high price = low yield), though they’re not nearly as expensive as some European bonds, which sell at a negative interest rate (that’s right, you pay them, instead of the other way around). Traditionally, bonds have been priced to yield the level of inflation plus 2–3%, which makes sense, as their purchasing power will decline over time due to inflation. Since inflation recently has been 2%, one would expect, in a “normal” world, to see 10-year bonds at 4–5%. So bonds might be priced well above where they “should” be; that is a huge risk. Yet the market is simply yawning at an investment that does not grow and has the potential to fall. Investors get used to novel conditions, and after some time has passed they begin to feel it’s normal.

Investors Yearning for Trade War’s End

And then there is the trade war, a war that has been going on silently, guerilla-style, for many years, but has just been publicly announced and weaponized. Investors everywhere are just waiting for a settlement so they can go off to the races again. It’s the trade war, they claim, that’s making them hold on to cash and flee from equities despite price increases.

Resolution of the trade war (let’s call it “dispute”) has become a kind of salvation investors look forward to as though this one simple thing can solve the complexities of their situation. .

Things Are Not So Bad After All

Strategists and investment houses have made much of a slowing economy, predicting in some cases a recession, in others a big fall for the markets. Putting aside the extremely spotty records of such predictors, in truth the data may have plenty of room for improvement toward a more perfect world.

Consumer and Service Economy Growing. We think the current vogue for negativity stems from a mindset that is still focused on data points that had greater significance when the economy—and the array of companies—was much more involved in things and manufacturing than it was in consumers and services, which dominate today’s economic activity.

Consumer and services businesses represent roughly 70% of our economy, and when seen through that lens things are not so bad at all. In fact on July 10, Fed Chairman Powell agreed with this assessment, calling the consumer side of the economy “strong.” As everyone knows, employment is as full as the history of employment may show, with an unemployment rate of 3.6% (we can remember when economists assured us that unemployment below 7% was a recipe for inflation, higher rates, and overall disaster). New claims for unemployment insurance continue to hover in the low 200,000s, a number that can only be seen as indicative of economic health—workers are not being fired. New job hires have become more modest, but the surveys of JOLTS (Job Openings and Labor Turnover Survey) are 50% higher than they were in December 2007 before the financial crisis, and today there are 0.8 workers available for every job. Ten years ago that number was 5.6 workers available to fill each job. The most recent (June 2019) Non-Manufacturing ISM® Report on Business® reading was 55.1%. That’s off a few tenths from previous, but still a robust reading showing growth in the largest part of the economy (50% is the dividing line between “good” and “bad”; a year ago it was 58.7%).

It is true that many companies have warned of soft earnings to be reported for the second quarter, but in fact the correlation between aggregate earnings reports is rather loose and random, since typically the market has been busy discounting those reports for months and weeks leading up to the reports. By far a greater concern is valuations, particularly among the sectors traditionally seen as defensives such as utilities and REITs, which are at historic highs per dollar of earnings or distributions. And yet, interest rates have been plunging. These sectors are more sensitive to rates than others, so, uncomfortable as it may make value investors who pay attention to historical valuations, there is at least a rationale.

Low Interest Rates Plus Negative Sentiment a Good Thing. Oddly, even though the market is at new highs strictly speaking, investors have no love for it, as detailed above and in many sentiment indicators. Various “business conditions” indicators published by major research firms have fallen in recent months. Yet the manufacturing data points are still positive in the US, as are the services data points. The negativity we hear today is more a prediction than an evaluation of what actually exists. What exists are low interest rates and negative sentiment. That’s not bad for stocks. That’s what pulled us out of dire straits a decade ago. While there’s no shortage of data to support fears of a worsening environment for investors, the economy remains modestly healthy, and that is what the market is certifying as we write. High valuations mean there may well be volatility in both directions of a sort that’s been little seen lately. And valuations may create a ceiling, but we think that seers’ predictions of a falling sky in the near future are mostly grabs for attention. Declines are likely to be transitory, in our view, and quality stocks bought at reasonable prices remain likely to provide decent returns—though it is doubtless a time for sober expectations.

Lowell G. Miller founded Miller/Howard Investments in 1984. Lowell has served as President and Secretary of Miller/Howard's Board of Directors, as well as President (Principal Executive Officer and Trustee) of Miller/Howard High Income Equity Fund, and Chairman of the Board of Trustees of Miller/Howard Funds Trust, since the funds’ inceptions in 2014 and 2015, respectively. He began his studies of the securities markets as an undergraduate and has continuously pursued the notion of disciplined investment strategies since 1976. He is the author of three acclaimed books on investing, including The Single Best Investment: Creating Wealth with Dividend Growth (Print Project, 2nd Edition, 2006). He has also written on financial topics for The New York Times Magazine, and has been a featured guest on Louis Rukeyser's Wall $treet Week and Bloomberg TV. Lowell is frequently quoted in financial media such as The Wall Street Journal, Dow Jones Newswires, Bloomberg, Fortune, and Barron's. He holds a BA in Philosophy from Sarah Lawrence College and a Juris Doctor degree from New York University School of Law.