Renewable Energy Demand

Monday, July 22, 2019

INVESTMENTS AS DRIVERS OF RENEWABLE ENERGY

- How can investors be players in renewable energy without investing in energy companies?

- We view many of our holdings as influential players in the move to a lower-carbon future—even though they don’t produce renewable energy for the market.

- These companies are generating renewable energy for their own use, committing to renewable energy use targets, and increasing the demand for renewable energy.

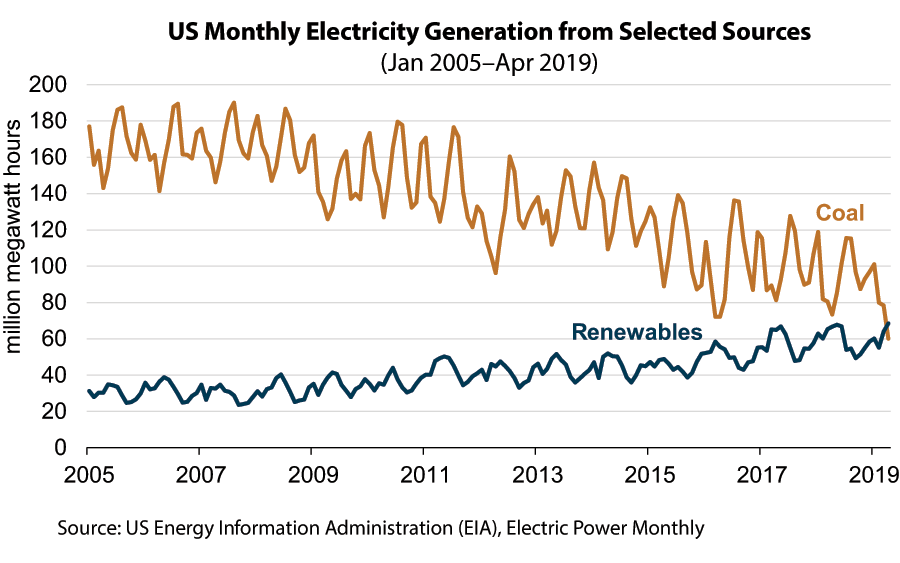

April was a watershed moment for renewables in US power generation, but how can investors be players in renewable energy without investing in energy companies?

Many of the companies in our portfolios are influential players in the move to a lower-carbon future— even though they don’t produce renewable energy for the market. They do this by generating renewable energy for their own use, by committing to renewable energy use targets, and by increasing the demand for renewable energy.

As we head into a carbon-constrained future, Miller/Howard believes that the future profitability of a company may depend in part on its ability to manage its energy needs through efficiencies and lower-carbon sourcing. Decreasing emissions, likewise, strengthens the company’s role in a more sustainable future.

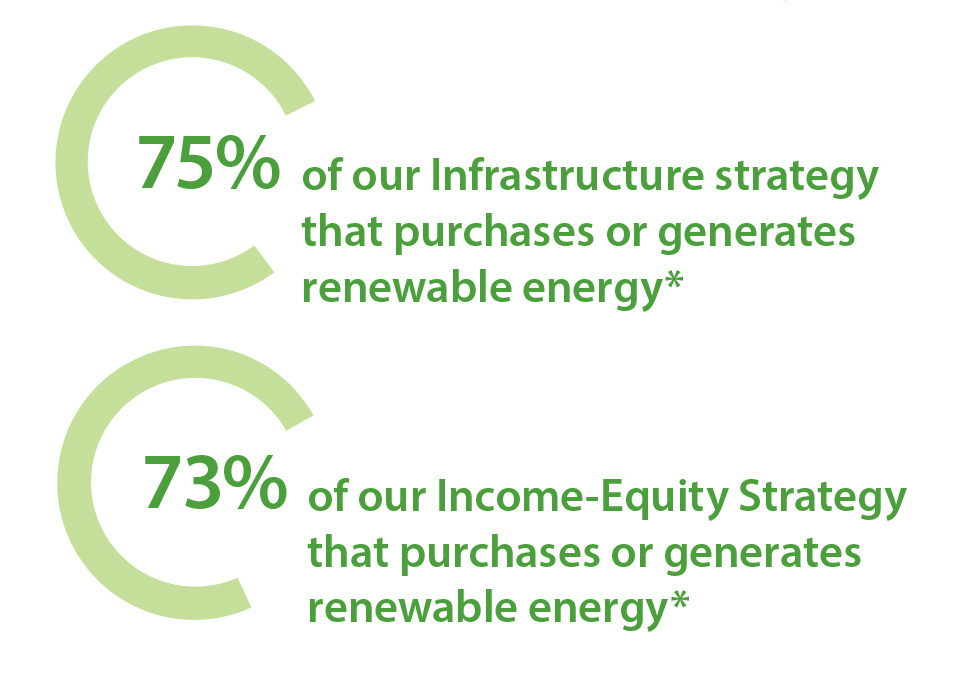

The charts to the right show the percentage of assets in our Infrastructure and Income-Equity Strategy (as of March 31, 2019) that rely on renewable energy. Companies that purchase or generate renewable energy for their own use—think solar panels on top of box stores or pipeline metering stations operating on 100% solar power—as well as those that generate renewable energy are important parts of the low-carbon transition and support future sustainability.

Increasingly, investors are demanding actions aligned with a sustainable future. As a result, we see more companies from seemingly unexpected sectors pivoting toward a lower-carbon future, driving demand for renewable energy. Commendably, some of the companies we invest in are setting public goals for carbon neutrality in the next few years!

*Holdings in Miller/Howard's Infrastructure and Income-Equity Strategy as of March 31, 2019. Percentage by weight.

Source: Miller/Howard Research & Analysis.

Nicole Lee provides operational and strategic leadership to Miller/Howard's ESG team. Nicole’s ESG research on portfolio holdings and candidates is integral to the firm’s investment process. Prior to joining the firm in 2014, she worked for several years as a clinic coordinator and educator for a nonprofit health organization, during which time she also developed and conducted training programs at two local universities. Nicole received a BS in Sociology from Southern Utah University, after which she studied public health at Westminster College in Utah.