Greg Powell: DO UNPROFITABLE COMPANIES BELONG IN YOUR PORTFOLIO?

“Surely not” most investors would say. Yet turn on any business channel and you will hear experts lauding the shining future of various growth and small-cap companies. Many of these companies have positive and growing earnings, but a surprising number of them are losing money.

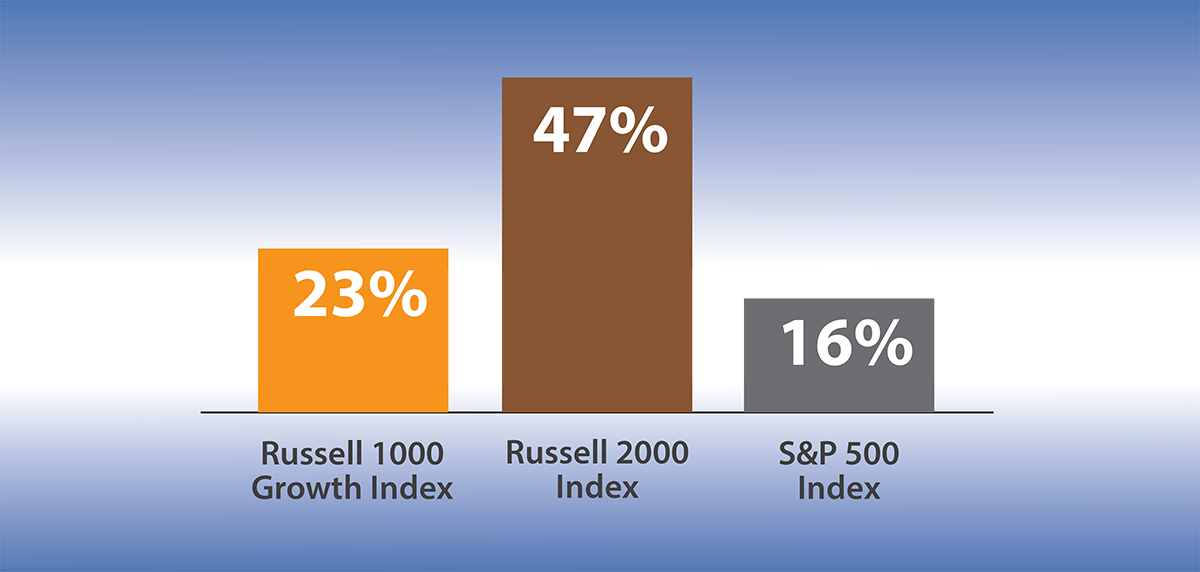

As of December 31, 2020. Source: Bloomberg.

*TTM = Twelve Trailing Months; EPS = Earnings Per Share

Universes are defined as members of the listed indexes (Russell 2000, Russell 1000 Growth, S&P 500) are market-cap weighted.

In the Russell 1000 Growth Index, 23% of the companies lost money last year. In the small-cap Russell 2000 Index, fully 47% were unprofitable in 2020. Even 16% of the S&P 500 Index names were unprofitable last year. Unprofitable companies are so ubiquitous that they can be found in virtually all retirement accounts, particularly for investors using passive funds or ETFs.

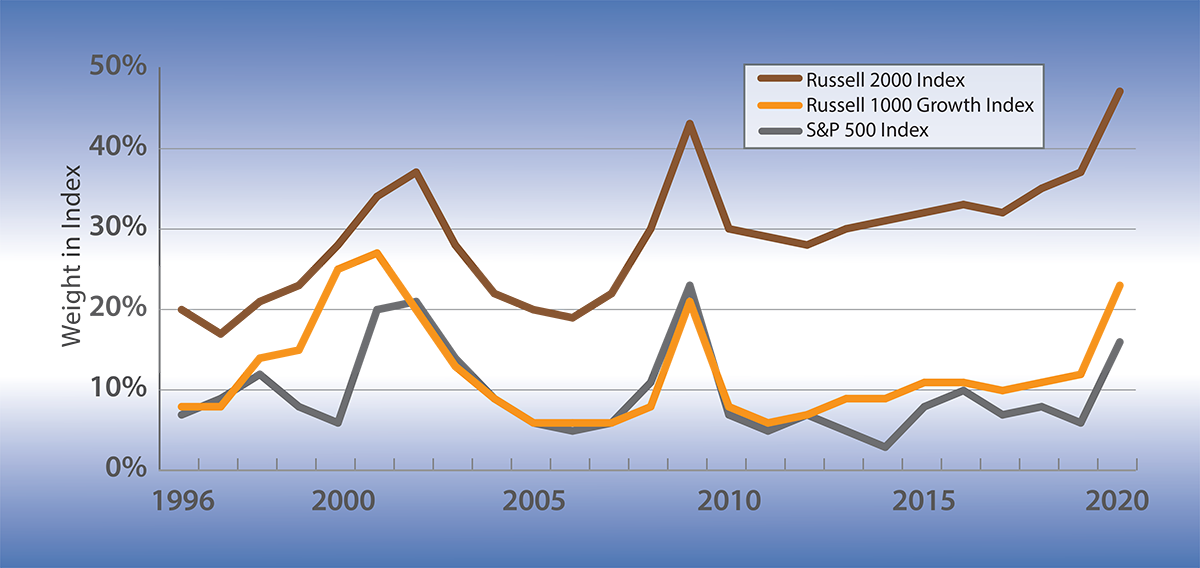

As of December 31, 2020. Source: Bloomberg.

*TTM = Twelve Trailing Months; EPS = Earnings Per Share

Universes are defined as members of the listed indexes (Russell 2000, Russell 1000 Growth, S&P 500) as of each calendar year end & are market-cap weighted.

This is not just an artifact of the pandemic. The chart above shows the fraction of unprofitable companies in the S&P 500, Russell 1000 Growth, and Russell 2000 indices over the last 25 years. As you can see, unprofitability rises in times of stress such as the end of the Internet Bubble, the Global Financial Crisis, and the COVID-19 pandemic. But the fraction of companies losing money in the broad market is persistently high. Among small-cap stocks, the percent of unprofitable companies has been trending up, reaching almost half of the Russell 2000 Index. It seems unlikely that the average saver would be comfortable investing in unprofitable companies to this extent.

Many people become wealthy by starting their own business, which, no doubt, has an unprofitable phase. Others do well by investing in small businesses started by friends or family members. But if your favorite niece or nephew is not destined to be the next Bill Gates or Jeff Bezos, can you reliably buy stocks to replicate that type of opportunity? Is investing in unprofitable public companies a good strategy?

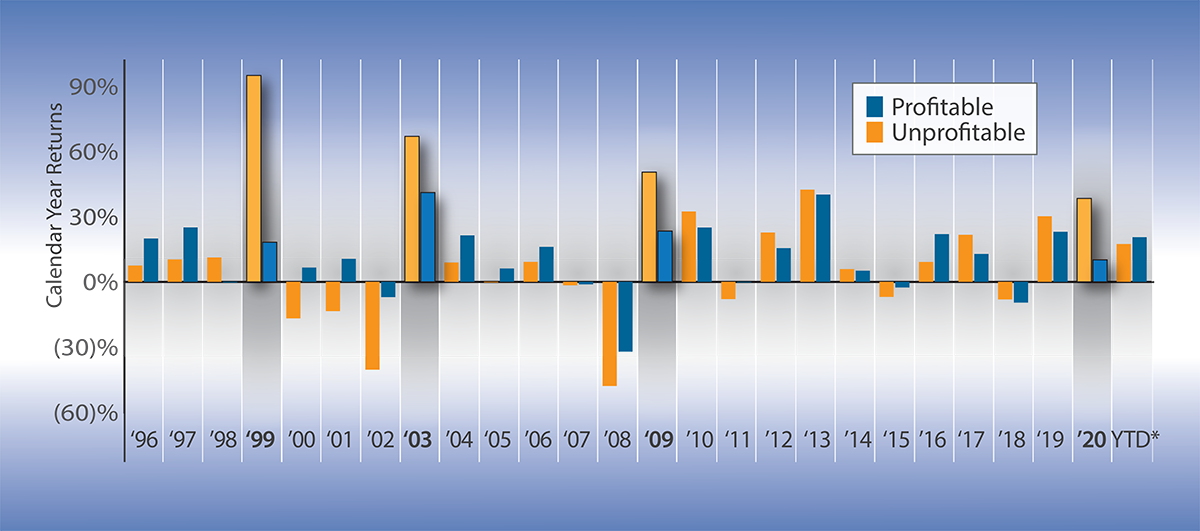

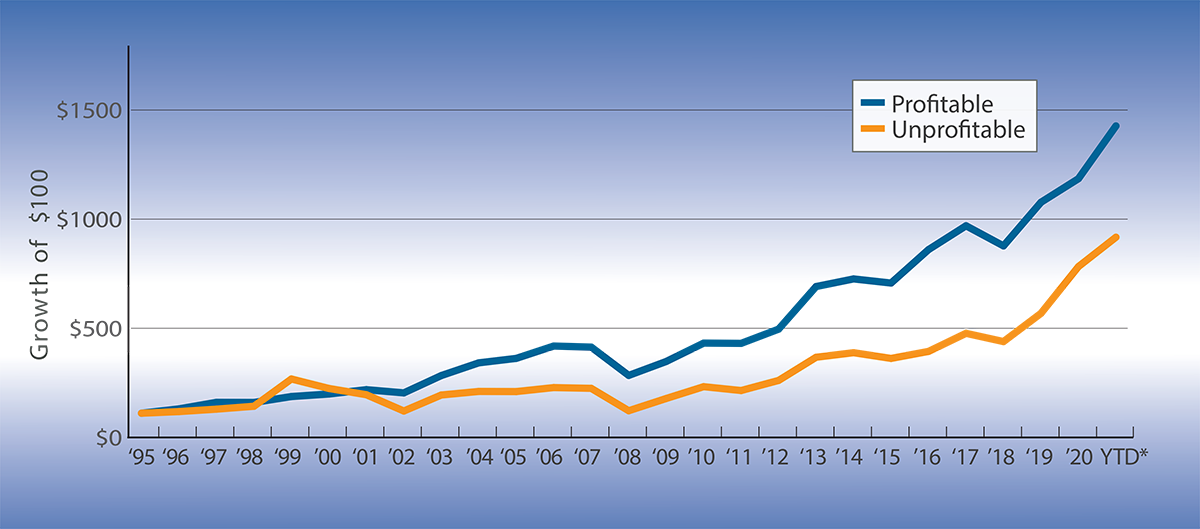

As of June 30, 2021. Source: Bloomberg; Miller/Howard Research & Analysis.

Note for charts: Unprofitable is defined as members of the Russell 2000 Index with negative trailing earnings per share as of each calendar year end. Profitable is defined as members of the Russell 2000 Index with positive trailing earnings per share as of each calendar year end. Both Unprofitable and Profitable are market capitalization weighted and rebalanced at year-end.

To answer these questions, we looked at investing in small-cap stocks—surely this is where money-losing acorns may grow to mighty oaks. The chart above shows the results of investing in unprofitable versus profitable small-cap companies in the Russell 2000 Index. As you can see, investing in unprofitable companies worked well just as the Internet Bubble was coming to an end, then did well again in the market recovery years of 2003 and 2009, and then had an excellent 2020.

As of June 30, 2021. Source: Bloomberg; Miller/Howard Research & Analysis.

Note for charts: Unprofitable is defined as members of the Russell 2000 Index with negative trailing earnings per share as of each calendar year end.

Profitable is defined as members of the Russell 2000 Index with positive trailing earnings per share as of each calendar year end. Both Unprofitable and Profitable are market capitalization weighted and rebalanced at year-end.

But this chart shows that on a cumulative basis, there is no contest—investing in profitable small-cap companies has generated much higher cumulative returns.

The high returns for money-losing stocks in 2020 was just one more sign of the recent rise in speculation gripping the investment world. From meme stocks to blank-check companies to cryptocurrency, we see vast sums of money being shoveled into vehicles that are the exact opposite of investing in known businesses with consistent cash flows.

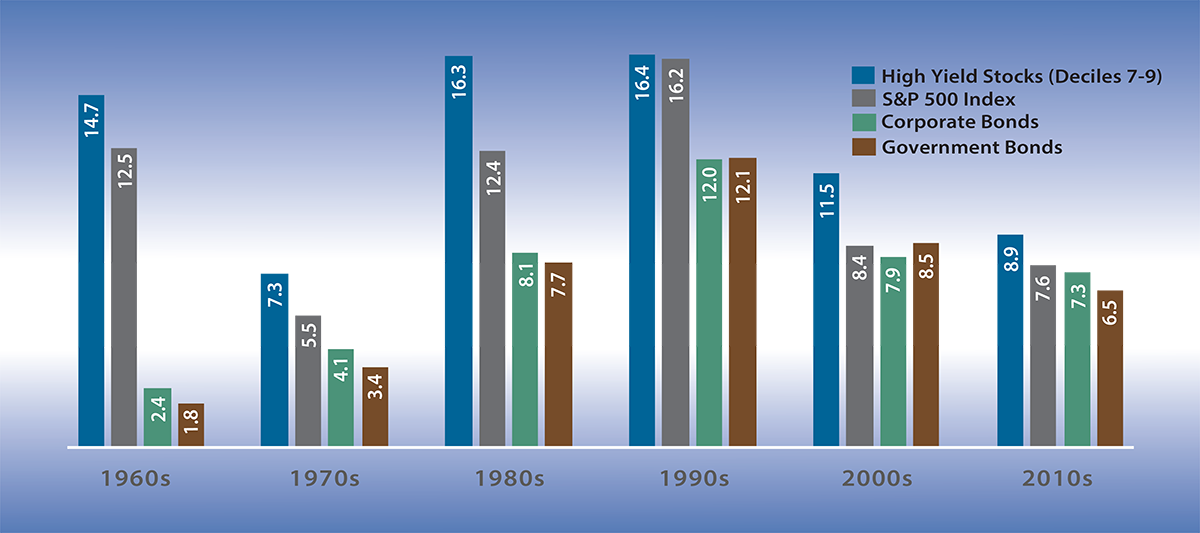

Data are through December 31, 2019. Based on the rolling 10-year annualized total returns, ending each calendar year, averaged by decade.

Source: Miller/Howard Research & Analysis; 2019 Stocks, Bonds, Bills and Inflation (“SBBI Yearbook”) and S&P 500 Index data as reported to Morningstar Direct.

High Yield Stocks data are provided by the Fama/French Research data library (value weighted deciles); Long-term government and corporate bond returns are based on the SBBI Yearbook.

At Miller/Howard, we have long advocated high-yield dividend stocks for long-term investors. The stocks we choose for our portfolios tend to have reasonable price-to-earnings multiples, good free cash flow, and relatively low debt levels. Using data going back to the 1950s, we have established that high-yield stocks have produced excellent returns for 10-year holding periods in every decade, better on average than the S&P 500 and better than bonds. Income investing works because, typically, companies must have sustainable earnings to commit to a regular dividend.

Investing always involves risks, but a track record of good earnings seems to be a logical place to start. In contrast, investing in unprofitable companies requires fairly heroic assumptions about the future. Income investing does involve having general views on the future, but we feel that ultimate success is much more dependent on the power of compounding than 20/20 foresight.

For more information, please visit us at www.mhinvest.com.

Note for charts: Unprofitable is defined as members of the Russell 2000 Index with negative trailing earnings per share as of each calendar year end. Profitable is defined as members of the Russell 2000 Index with positive trailing earnings per share as of each calendar year end. Both Unprofitable and Profitable are market capitalization weighted and rebalanced at year-end.