Michael Roomberg, CFA: Over the past decade, energy has been among the worst performing sectors of the market, as producers repeatedly flooded the market with oil and gas, collapsing prices, leading to disappointing investor returns.

In recent years, key changes have been quietly brewing in the industry that we believe set it on a course to be less volatile, with better returns for shareholders, particularly those seeking income.

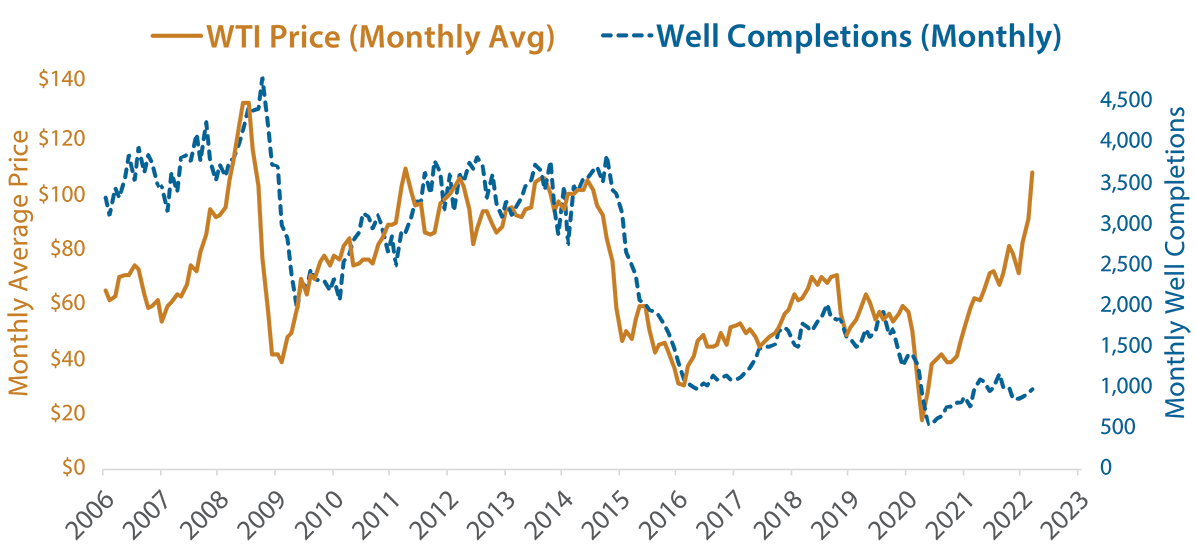

As of March 31, 2022. Sources: EIA; Eikon; Miller/Howard Research & Analysis.

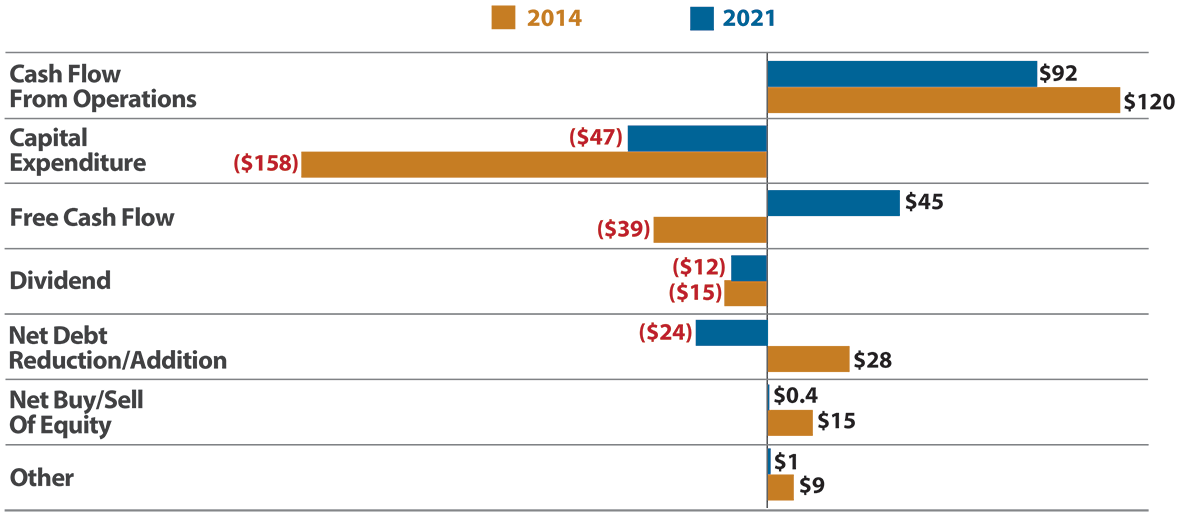

For illustrative purposes, 2021 data has been compared against 2014, which was the most recent peak in E&P industry cash from operations. Well completions are the monthly total of crude oil, natural gas, and dry wells drilled in the US.

In past years, as oil prices moved higher, drillers received more cash, drilled more wells, and stopped drilling only when prices eventually crashed and money ran out.

When commodity prices were high, there were no dividends because all the money went to more drilling. When prices were low, there was no money for dividends, because, well, there was no money. There’s an old adage that an oil driller rarely sees a well not worth drilling. Up until recently, that’s been true.

But investors have said, “no more” to this vicious cycle. Producers now know that unconstrained spending will swiftly result in underperforming stock prices.

A new approach is increasingly clear. Energy companies sharply curtailed production in 2020, as would be expected with low oil prices. Since then, oil prices have rebounded sharply, but companies have not responded with an overwhelming wave of new activity.

As the shale production has matured and consolidated, remaining companies have embraced capital discipline. We believe production will still grow this year, but it will occur at a sensible pace, and cash earnings should well-exceed drilling expenditures. While the ability to bring on more supply remains, the willingness has clearly changed, with energy companies prioritizing cash returns over maximizing growth.

Sources: Bloomberg; Miller/Howard Research & Analysis. For illustrative purposes, 2021 data has been compared against 2014, which was the most recent peak in E&P industry cash from operations. The Standard Industrial Classification (SIC) is a system for classifying industries. The E&P universe was defined by using SIC codes 1311 & 1381 with a market capitalization of $200 million or higher.

This chart shows aggregated cash flow for publicly traded E&Ps in North America. In 2014, the industry generated $120 billion in cash from operations but spent $160 billion drilling new wells. This $40 billion free cash flow short fall meant, not only were dividends unaffordable, but that companies had to sell dilutive equity and raise costly debt.

2021 tells a much different story. Last year, oil prices averaged just $68/bbl, 25% lower than the $93/bbl that the industry enjoyed in 2014. While the industry generated about 25% less cash from operations versus 2014, it cut drilling spending 70% compared to that year, resulting in $45 billion of POSITIVE free cash flow in 2021. This enabled payment of $12 billion in shareholder dividends, and a $25 billion reduction in debt, leaving the industry in its healthiest financial condition in years.

This year, oil prices have averaged well over $100/bbl and cash flows are tracking nearly 50% higher. Investors have been rewarded with large dividend increases, special dividends, and buybacks.

Recent events remind the public that reliable energy supplies are critical for a healthy global economy, and that North American producers must play a key role in meeting this demand for years to come. What’s even more clear in our view is that these companies have now charted a course to do so in a way that is fiscally sustainable and features persistent cash returns to shareholders over time.

For more information, please see our website at mhinvest.com.