Bank Dividends Chug Along

Monday, January 18, 2021

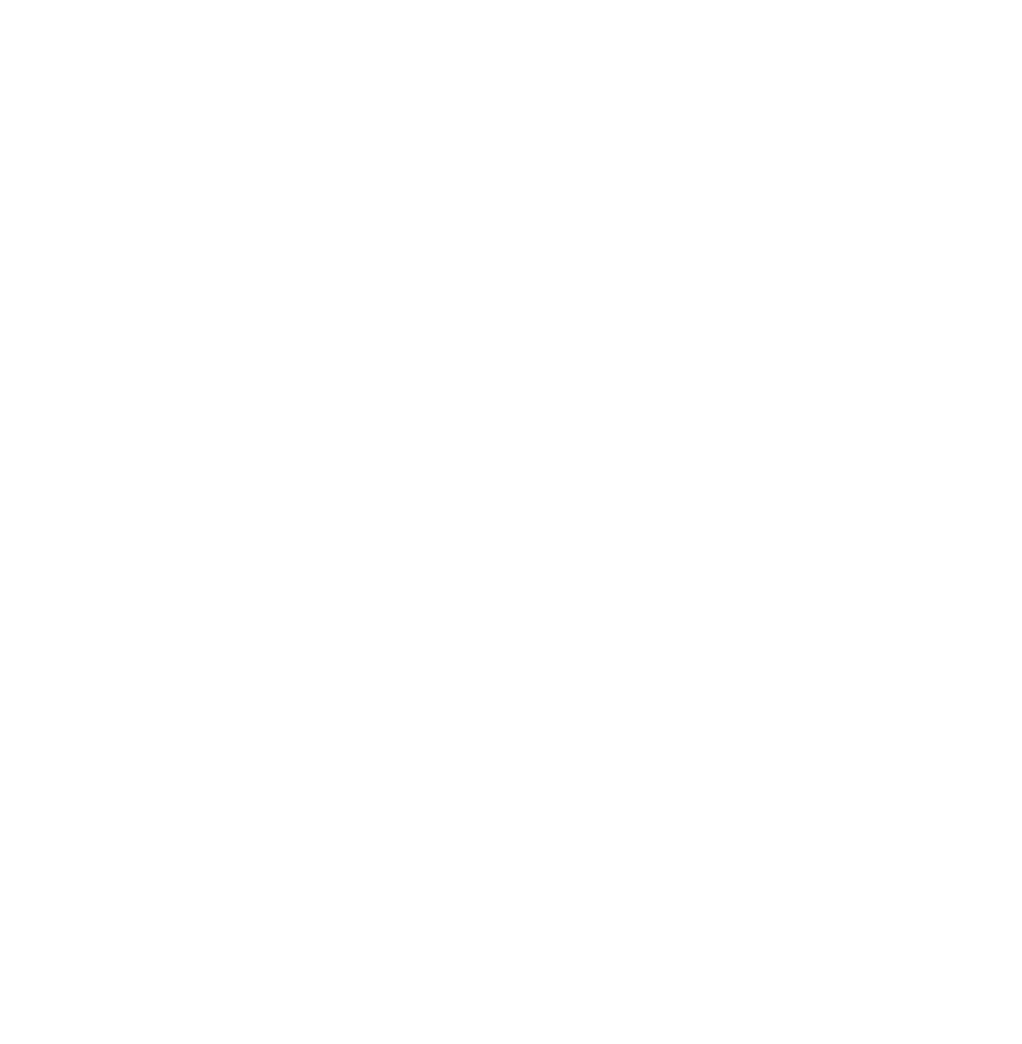

Large US Banks: Dividend Changes

* As of December 22, 2020.

Source: Bloomberg; Miller/Howard Research & Analysis. Large US Banks are defined as those that currently participate in Fed stress testing. The Federal Reserve halted dividend increases in June 2020.

At the outset of the pandemic, strong voices called for the elimination of bank dividends. The argument was that banks would need as much capital as possible to cover credit losses caused by COVID-19. The Fed took a more moderate view, halting dividend increases but allowing dividends to continue as long as they were covered by earnings over the trailing four quarters. In contrast, the Fed stopped all share repurchases. Banks had been spending more than double on share repurchases relative to dividends, so the prohibition on buybacks did much to bolster balance sheets.

Following the annual bank stress test in June, the Fed announced that banks would be put through an additional stress test in the fall using Coronavirus-driven recession scenarios. Based on this analysis, the Fed announced on December 18th that the largest banks have more than enough capital to continue lending even if the economy deteriorates significantly from here. Dividend increases are still on hold, but the Fed is once again allowing share repurchases.

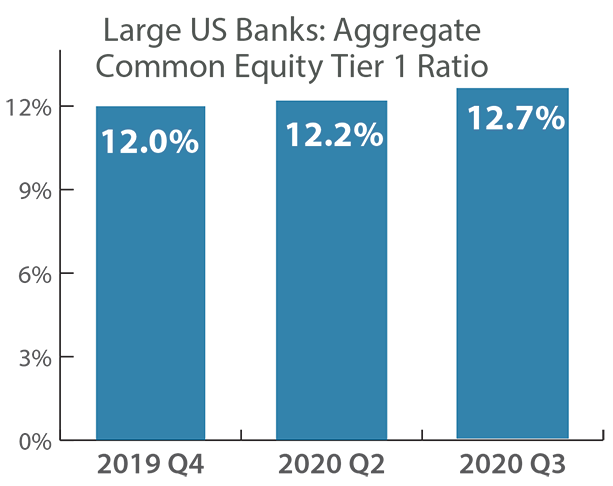

The key point in the Fed’s analysis is just how strong bank balance sheets are now. As a group, despite doubling the reserves set aside for potential (but not realized) loan losses, banks actually improved their capital metrics during 2020, as earnings were substantially more than dividends paid. The Fed’s stamp of approval on bank credit metrics should build investor confidence, based on the Fed’s unique ability to peer into non-public details of each bank’s financial health.

Capital Metrics Improved in 2020

* Source: Executive Summary of the Fed’s December 2020. The common equity tier 1 capital ratio is the primary metric the Fed uses to judge bank capital adequacy.

What does all this mean for income investors? Out of the 22 large US banks, only Wells Fargo and Capital One (neither is owned by Miller/Howard) cut dividends during 2020. Banks proved to be a reliable source of dividends, even during a difficult period. It is true that the Fed has not yet allowed the dividend increases that we seek, but the money is literally “in the bank,” meaning that excess capital has accumulated. We expect regulators to allow dividend increases once we get closer to the end of the pandemic, provided credit losses are not substantially above expectations. In the meantime, buybacks reduce shares outstanding, making dividend increases more affordable.

Link to the 4Q20 Quarterly Report ►