Using ESG to Prepare Your Portfolio for Climate Change

Tuesday, November 30, 2021

Science suggests, with increasing confidence, that climate change will impact each person, each company, and each country—albeit in different ways.

At Miller/Howard, we ask these questions of the companies we invest in, and of ourselves:

- How does a company identify its risks?

- What are its blind spots?

- What are its strategies for the short and long term?

We are committed to managing the risks we see to ensure that our portfolios’ risk exposures suit our clients’ risk appetites.

Miller/Howard’s Climate Change Risk Management Approach

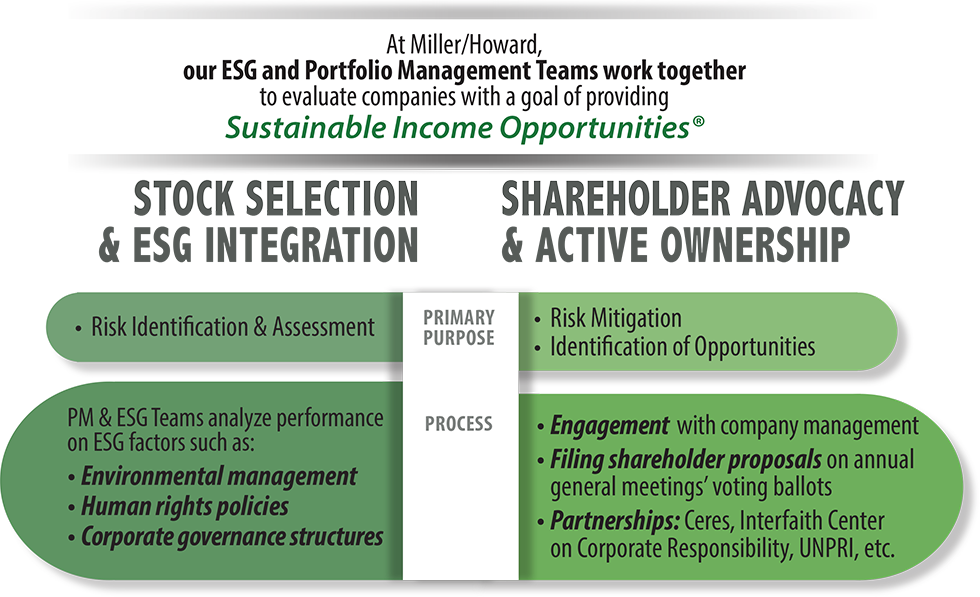

We assess and manage our climate-related risks and opportunities through a multi-level approach:

- Firm-level —Our strategy encompasses and benefits all of Miller/Howard, from executive and board oversight to participation from each department.

- Portfolio-level —Using quantitative and qualitative analysis, we ensure that our portfolios have appropriate levels of risk for our philosophy and goals.

- Company-level —Once a company enters our portfolios, we vote all proxy ballots according to our ESG Policy. We also become “active owners” through our shareholder advocacy program, in which we engage company management on topics such as disclosure of emissions and science-based emissions reduction targets, Paris Accord-aligned lobbying activities, and analyze how a company might fare under various future climate scenarios.

We strive to provide Sustainable Income Opportunities® using our Guiding Values as our compass.

|

Exemplary Governance & Corporate Citizenship

|

|

Sustainability, Equity & Inclusion

|

|

Strong Disclosure & Resource Management

|

|

Responsible Climate Change Approach

|

Just as we push companies to be better—positioning for long-term profitability and accountability to their investors—we constantly assess our own process. To this end, in 2021, we updated our Guiding Values to include 'responsible climate change approach' as a fourth pillar. Previously, we considered a company's climate change strategy within the context of resource management, disclosure, environmental risks, and sustainability. However, we feel the time has come to prioritize this commitment and recognize it as a unique pillar.

The Miller/Howard Climate Change Working Group launched in 2020

In recognition of the systemic risks posed by climate change, Miller/Howard launched an internal Climate Change Working Group (CCWG) in 2020. CCWG is a cross-departmental initiative that reports directly to Miller/Howard’s president, and is comprised of representatives from all departments. The group considers physical and transition risks associated with climate change, takes an expansive and critical look at Miller/Howard’s existing policies and practices, and provides forward-looking insights that can support us in our goals.

Miller/Howard’s multi-decade commitment to ESG provided a solid foundation, from which we could refine a more fulsome program and build on existing capacities, successes, and talents. We chose to distinguish “climate change” as a unique consideration that, while closely tied to environment, is not equivalent in concept or implications.

Additionally, the CCWG has worked to:

- Consolidate existing policies and practices that relate to climate change into one cogent, clear strategy, to reduce redundancies and increase the efficiency and efficacy.

- Look for gaps, opportunities, and blind spots.

- Support greater risk assessment as well as new insights, ideas, and adaptations.

We encourage all to use this information to reflect on your own strategy and preparation, whether it’s in service of your clients or your own investments and financial goals. Miller/Howard stands at the ready to partner with those seeking our Sustainable Income Opportunities®.

Read Miller/Howard’s full Climate Change Risk Management Strategy ►

Nicole Lee provides operational and strategic leadership to Miller/Howard's ESG team. Nicole’s ESG research on portfolio holdings and candidates is integral to the firm’s investment process. Prior to joining the firm in 2014, she worked for several years as a clinic coordinator and educator for a nonprofit health organization, during which time she also developed and conducted training programs at two local universities. Nicole received a BS in Sociology from Southern Utah University, after which she studied public health at Westminster College in Utah.