Hi I’m Michael Roomberg, Portfolio Manager with Miller/Howard Investments.

Investors frequently ask us about the dramatic shift toward more shareholder-friendly policies at North American energy companies. We’ve seen improvements in areas of cash flow generation, capital allocation, capital returns policies (including buybacks and dividends), and even areas of environmental stewardship.

Investors ask us:

“Will it continue—or will management teams abandon good behavior as the sector returns to favor following several years of strong shareholder returns?”

Our answer is that we expect these shareholder-friendly policies to continue, and the reason is imbedded in improved management compensation incentive design.

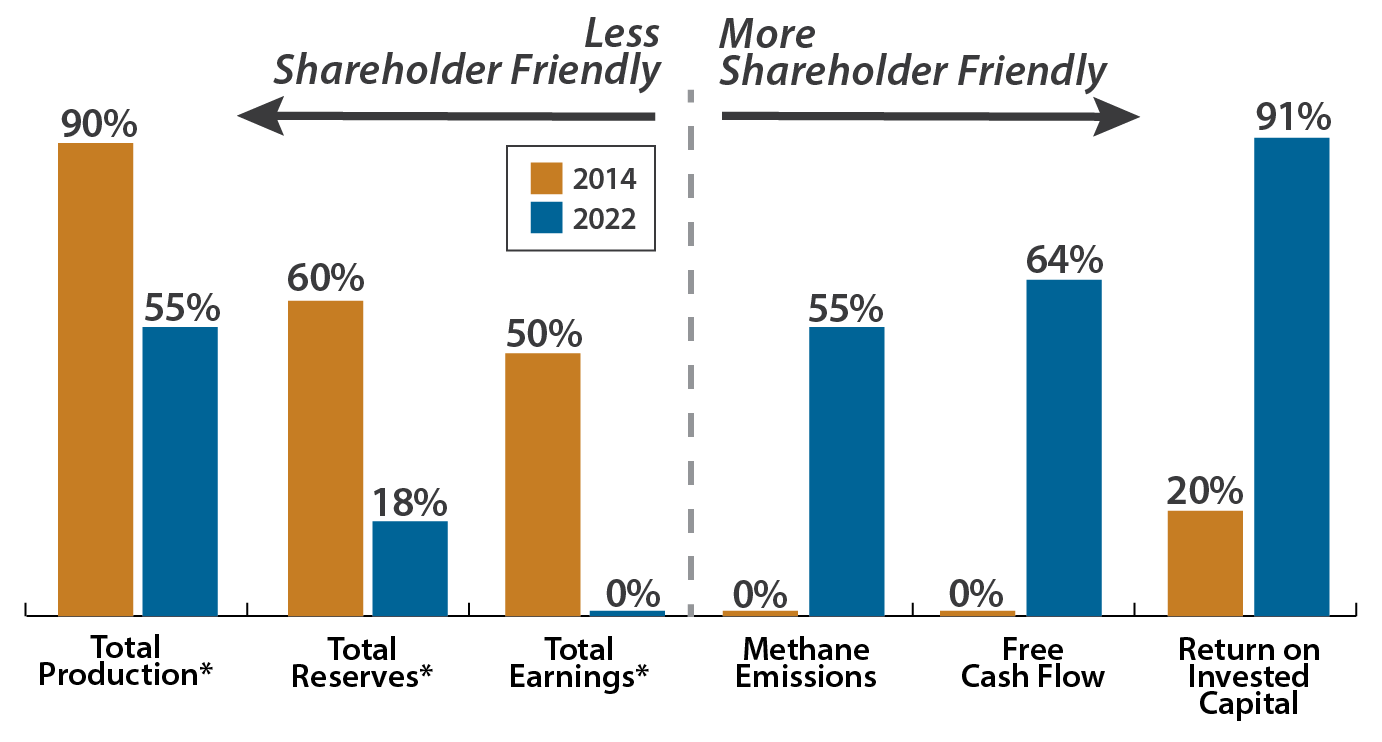

Owned Currently vs. 2014

Sources: Company proxy statements; Miller/Howard Research & Analysis. Return on invested capital includes capital efficiency metrics including ROE, ROIC, and ROCE. Free cash flow represents cash from operations less capital expenditures and similar representations.

*Not per share

We analyzed the proxy reports of the upstream E&P (exploration and production) holdings in our North American Strategy. Comparing the stocks held today with the ones owned in 2014, we identified shifts in management incentive compensation design and other governance items. Specifically, we looked at the discipline to avoid high growth boom-and-bust investments, to return capital to shareholders, and to shift towards growing earnings.

Importantly, we looked for incentives tied to earnings growth on a per share basis—not on an absolute basis that grows the company size but doesn’t necessarily benefit existing shareholders.

We were encouraged by this analysis. In 2014, incentives focused on growing total production and reserves, regardless of cost and potential benefit to shareholders. In 2014, about half of management teams were incentivized based on “total earnings” targets. Today, none of the companies in our portfolio have this pay structure.

But what we find most important are the shifts on cash flow and returns on investment. In 2014, improving these critical metrics was rarely incentivized. Today, it predominates the way management teams get paid. Finally, more than half of companies have incentivized managers on methane emissions management and other environmental stewardship items. This change has helped companies get ahead of regulation and adopt best practices.

We view these changes as representative of the industry evolution. They are a key reason why, last year, in the face of $100 per barrel of oil, drilling expenditures were fairly stagnant.

Instead of justification to chase more volume, profits from high selling prices were treated as “found money” to be returned to the company’s rightful owners—the shareholders—through regular dividends, share repurchases, and variable special dividends. And the reason, we think, is better management incentives.

At Miller/Howard, we think that engaging management on good corporate governance can lead to better returns for investors. Our efforts seek to push companies toward continuous improvement that we believe will bear fruit for investors in the years ahead.

For more information, please visit our website, mhinvest.com.