Adam Fackler: Growth opportunities among utilities are the highest in recent memory.

Outside of the need to repair our aging infrastructure, spending is being driven by grid modernization, including preparation for the electrification of the transportation fleet, and a transition to renewable energy.

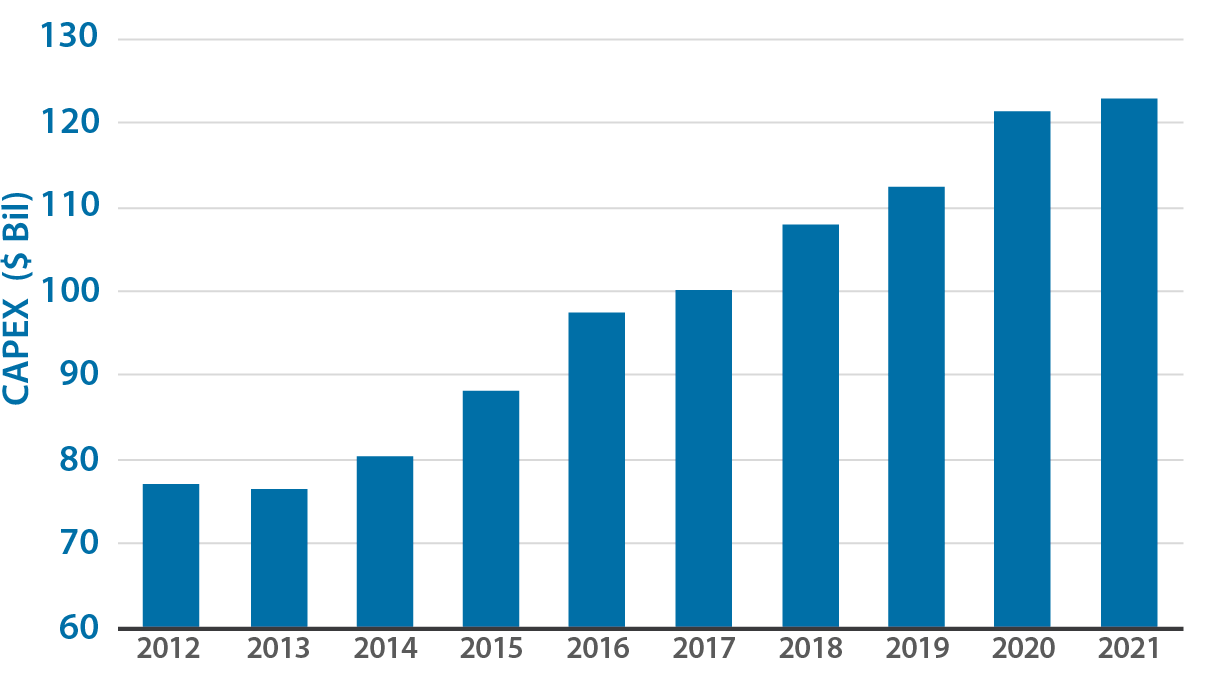

From 2011-2021, electric utilities increased annual capital expenditures by approximately 60%. Given strong regulatory support, with much of the spending tied to state and federal decarbonization targets, the trend seems unlikely to abate in our view.

According to the EIA, renewables are expected to increase from 21% of US electricity generation in 2021 to roughly 44% by 2050.

As of December 31, 2021. Sources: Bloomberg; Edison Electric Institute; Miller/Howard Research & Analysis.

Universe includes the 37 publicly traded US electric companies in the Edison Electrical Institute Index at the end of 2021.

In most industries, higher capital outlays are viewed as risky—in that companies only earn a return on investment if their plans play out.

In contrast, regulated utilities are allowed to raise rates consumers pay in order to recover their capital investment and earn a return on equity. As a result, spending levels have a formulaic connection to earnings growth.

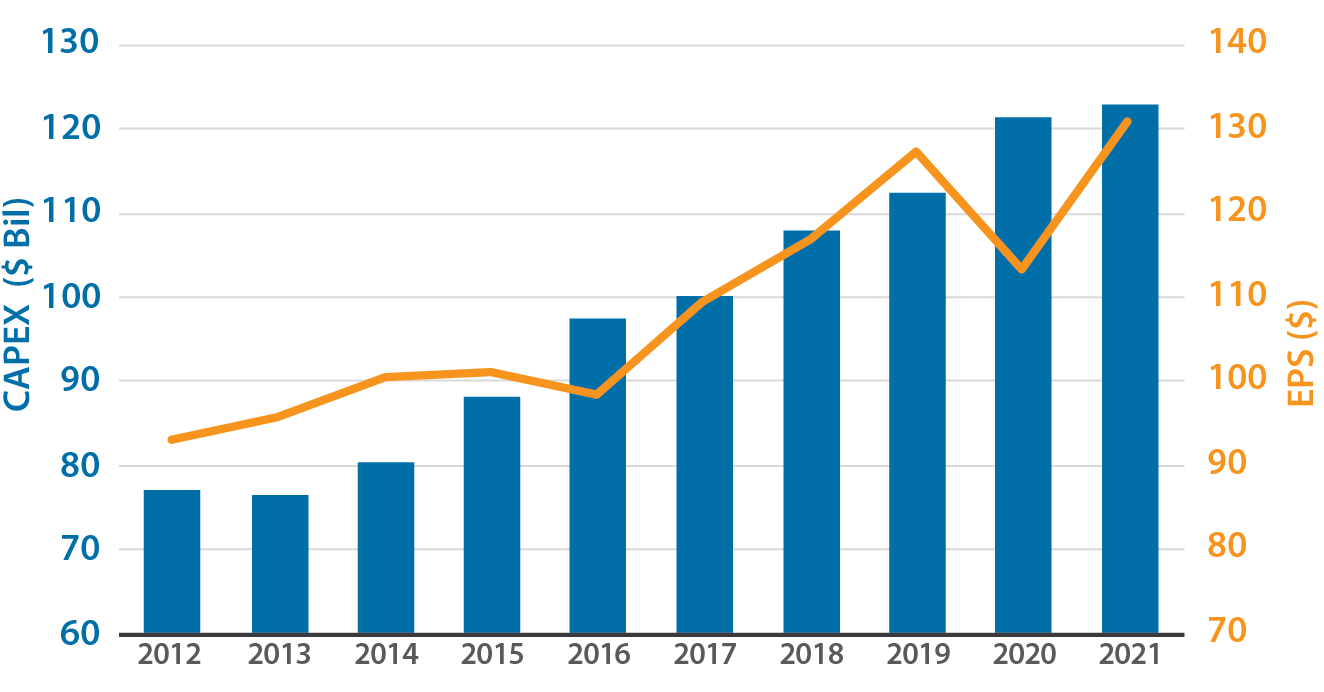

Electric utility earnings have generally tracked capital expenditures with the exception of 2020 when results were impacted by the COVID-19 pandemic. Most companies are guiding to EPS growth of 5-8% which suggests an acceleration from the last decade.

With that said, bill pressure could cause regulators to slow the growth of allowed investment and consequent earnings growth. All else being equal, higher spending levels and expenses—including natural gas prices—would put upward pressure on customer bills and likely create a bit of a balancing act for utilities.

As of December 31, 2021. Sources: Bloomberg; Edison Electric Institute; Miller/Howard Research & Analysis.

Universe includes the 37 publicly traded US electric companies in the Edison Electrical Institute Index at the end of 2021.

Utilities are not guaranteed earnings; they must execute. Yet currently, we believe the setup seems favorable for the sector given the agreement between companies and regulators on the need to fix our infrastructure and shift generation towards renewables energy.

With a need established, stakeholder interests seemingly aligned. And with a regulatory construct designed to provide a reasonable return on investment, we expect industry fundamentals to provide investors with a dependable and growing dividend stream.

For more information, please see our website at mhinvest.com.

Capital expenditures (Capex) are funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment.

Earnings per share (EPS) is a company’s net profit divided by the number of common shares it has outstanding.